owner's draw in quickbooks self employed

The owners draw is the distribution of funds from your equity account. Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use.

How To Cancel Quickbooks Self Employed 2022 Guide Justuseapp

An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

. QuickBooks Self-Employed QBSE does not have a Chart of Accounts where you can set up equity accounts unlike QBO. Only profits or losses have. Ive looked into quickbooks self employed and a big thing for me is having multiple lines on one.

Also you cannot deduct the owners draw as a business. Step 4 Click the Account field drop-down menu in the Expenses tab. Im self employed in the UK and looking for a new book keeping app.

An owner of a sole. Business owners generally take draws by writing a check to themselves from their business bank accounts. Youre allowed to withdraw from your share of the businesss value through an owners draw.

For accounting purposes the draw is taken as a negative from their business. A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. Say you open a company with your friend as equal partners each putting up.

Select Petty Cash or Owners. Owners Draw on Self Employed QB. Learn about Recording an Owners Draw in Intuit QuickBooks Pro 2021 with the complete ad-free training course here.

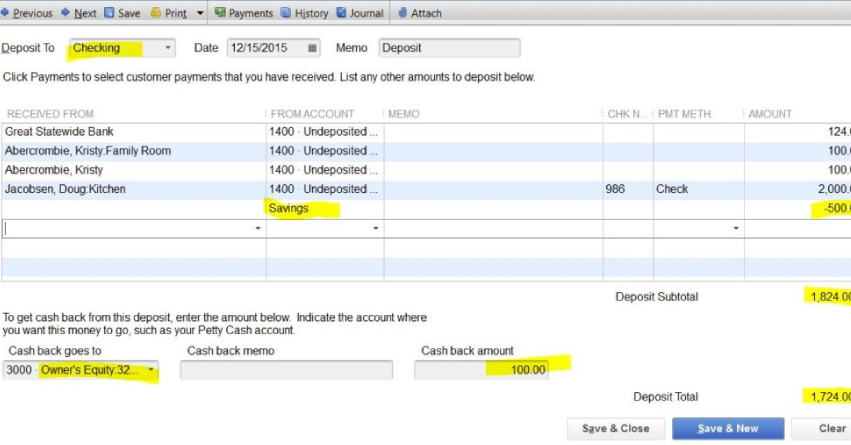

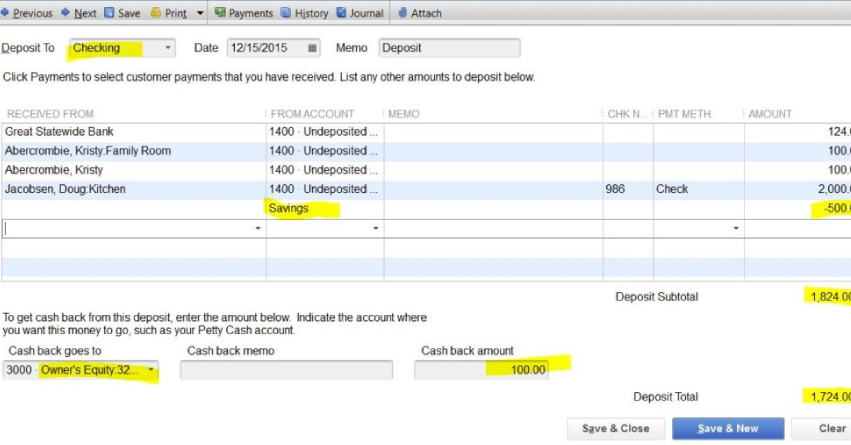

Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account. An owners draw is a one-time withdrawal of any amount from your business funds. See How QuickBooks Saves You Time Money.

At the end of the year or period subtract your. We managed three companies Ill focus on two of them since I dont think. Ad Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers.

QuickBooks Self-Employed is meant for small business generally one-person operations that need a way to track business income and expenses separate from their. Help with Owner Salary or Draw Posting in QuickBooks Online. Therefore the procedures for owners draws are the same as those described above.

Instead you make a withdrawal from your owners. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the.

Type the owners name if you want to record the withdrawal in the Owners Draw account. A draw lowers the owners equity in the business. This leads to a reduction in your total share in the business.

Start Your Free Trial Today. See How QuickBooks Saves You Time Money. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Ad Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. For background our company used Quickbooks Enterprise for quite some time until 2017 last version we bought. As a business owner you are required to track each time you take money from your business profits as a.

However owners cant simply draw as much as they want. The draws do not include any kind of taxes including self. So handling owners draws doesnt have to be complicated.

They can only draw. Start Your Free Trial Today. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

Download Quickbooks Self Employed Mileage Tracker And Taxes On Pc With Memu

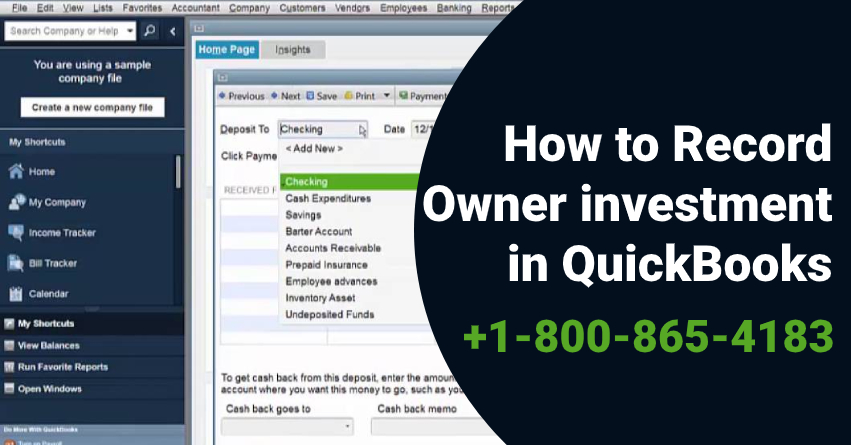

How To Record Owner Investment In Quickbooks Updated Steps

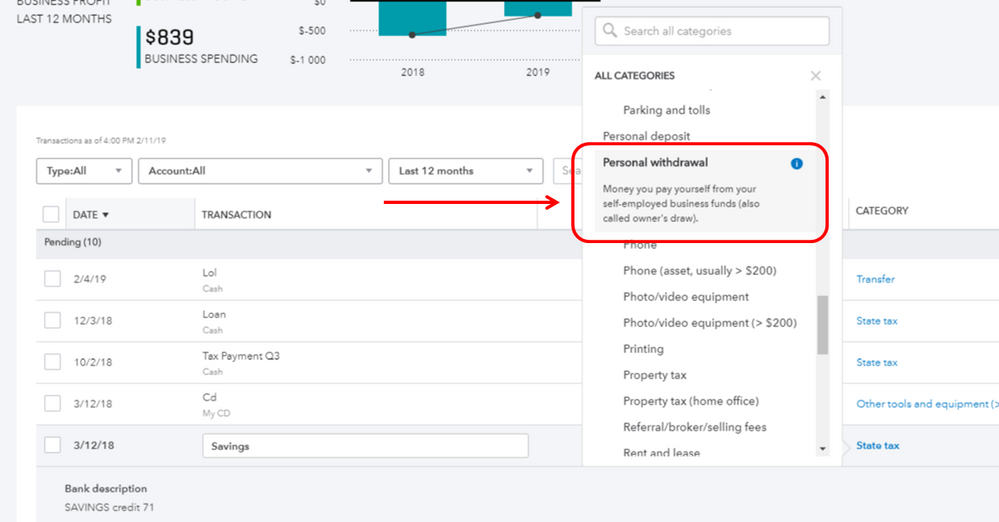

Categorizing Transactions In Quickbooks Other Bookkeeping Software Network Antics

Quickbooks Self Employed Complete Tutorial Youtube

Quickbooks Self Employed Review My Most And Least Favorite Features Youtube

How To Record Owner Investment In Quickbooks Updated Steps

Quickbooks Self Employed App Explained 5 Minute Tutorial Youtube

.jpg)

Ppp Loan Forgiveness For Sole Proprietors And The Self Employed Hourly Inc

Quickbooks Online Pricing Which Plan Is Right For You In 2022

Solved Owner S Draw On Self Employed Qb

Self Employed Payroll How To Process Your Own Paycheck

Hurdlr Vs Quickbooks Online In Depth Comparison 2021

Self Employed Era Is Quickbooks Worth It Quora

Tutorial 2020 Quickbooks Self Employed Youtube

Keeping Up With All The Things How Intuit Quickbooks Self Employed Helps Me Track Prep For Tax Season Quickbooks Tax Season Keep Up

Solved Owner S Draw On Self Employed Qb

Taking Self Employed Drawings How To Record Money Your Pay Yourself Using Quickbooks Online Youtube